|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

The Average Cost to Refinance: Understanding the Expenses and BenefitsRefinancing your mortgage can be an excellent way to lower your interest rate, change the term of your loan, or access home equity. However, it's essential to understand the average cost to refinance and the potential benefits involved. In this article, we will explore these costs and provide insights into how refinancing might benefit you. Understanding Refinancing CostsThe average cost to refinance house can vary widely depending on several factors such as loan amount, property location, and lender fees. Generally, refinancing costs can be categorized into several key components. Key Cost Components

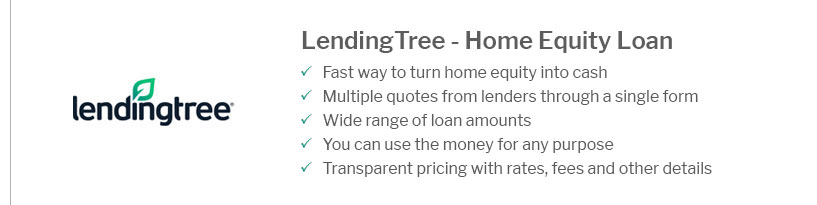

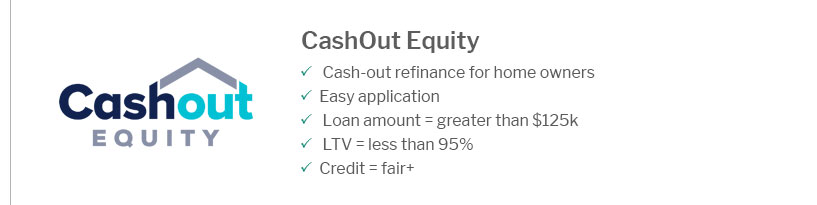

Benefits of RefinancingRefinancing can offer several benefits that make the upfront costs worthwhile. Here are some potential advantages: Lower Interest RatesOne of the main reasons homeowners refinance is to secure a lower interest rate, which can lead to substantial savings over the life of the loan. Changing Loan TermsRefinancing allows you to alter the loan term. Whether you want to extend the term for lower monthly payments or shorten it to pay off your mortgage faster, refinancing can help you achieve your financial goals. Accessing Home EquityThrough a cash-out refinance, you can tap into your home's equity for significant expenses like home improvements or education costs. This option can be more cost-effective than other financing methods. Considerations Before RefinancingBefore deciding to refinance, it's crucial to evaluate your financial situation and the break-even point, which is how long it will take to recoup the costs of refinancing through savings. Also, explore different options to find the best deal. For example, understanding who does FHA streamline refinance might offer you a low-cost way to refinance if you have an existing FHA loan. FAQs About RefinancingUnderstanding the average cost to refinance house and weighing the benefits can guide you in making an informed decision. Whether you're seeking lower payments, a better interest rate, or access to home equity, refinancing may be a beneficial financial move if the costs align with your financial plans. https://www.newamericanfunding.com/learning-center/homeowners/how-much-does-it-cost-to-refinance-a-mortgage/

Origination fees cover the administrative costs that go along with preparing mortgage documents. They can total up to 1.5% of a new loan amount. https://www.experian.com/blogs/ask-experian/how-much-does-it-cost-to-refinance-mortgage/

Refinancing a mortgage commonly costs between 2% to 6% of the loan amount. Take these costs into account when weighing whether or not to ... https://www.reddit.com/r/RealEstate/comments/1brv6tb/on_average_what_is_the_cost_of_refinancing_is_it/

Depends on when it's done. I've done two refinances over the years and one was no closing costs and the most recent one was $500 and that's it.

|

|---|